Presidential Palliative Programmes

Transforming businesses, improving lives.

Revolutionizing Financial Support

Introducing The Presidential Palliative Programmes -

A Game-Changer in Economic Empowerment.

Application Portal: https://loan.fedgrantandloan.gov.ng/

Registration Form: https://loan.fedgrantandloan.gov.ng/auth/loan-register

Presidential

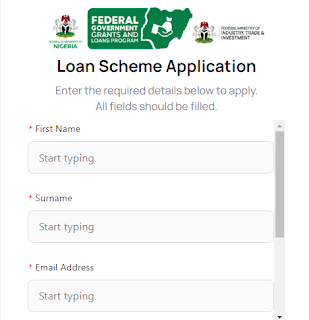

Palliative Programmes Application Procedure

1.

Create an Account

Sign

up with the your basic details

2.

Business Information

Enter

your business information with the necessary documentation

3.

Directors

Provide

information about your business leadership

4.

Loan Information

Provide

information about what the loan will help your business with

5.

Preview

View

and cross-check the information you supplied and submit your application

Presidential Palliative Programmes Target Sectors

Below are the businesses that are eligible to apply to the scheme

Traders

These include single retail marketers, corner

shop owners, petty traders, market men and women in open markets

Food

Services

These include food, fruits and vegetable

vendors, etc

ICT

These include business centre operators,

battery chargers, recharge card vendors, call centre agents

Transportation

These include wheelbarrow pushers, independent

dispatch riders

Creatives

These include makeup artists, fashion

designers, drycleaners.

Artisans

These include vulcanizers, shoemakers,

painters, repairers.

Presidential Palliative Programmes Loan Eligibility Criteria

1. Loan up to 1M

o A) Eligibility Criteria

·

Existing business

must be in operation for one (1) year,

·

Start-ups must be

a registered business

·

Provide CAC

business registration documents.

·

Company’s Bank

Statement(s) for a period of one (1) year (for existing business)/ Chief

Promoter’s (Director or Business owner) Bank Statement(s) for a period of

one (1) year (for startups).

·

Have required

monthly turnover and other things as may be requested by the bank.

o B) Security

·

Personal

Guarantee of the promoter

·

Acceptance of BVN

Covenant (Global Standing Instruction- GSI), and any other thing that may be

required by the bank

o C) Repayment Frequency

·

Monthly equal

installment (no moratorium) over a period of 3 years

2. Manufacturers up to N1billion (Working Capital

or Asset Financing)

o A) Eligibility Criteria

·

At least 6months

business/ corporate banking relationship

·

Provide CAC

business registration documents

·

12 months bank

statement for other bank

·

Other

documentations that may be required by the bank.

o B) Security

·

As may be

required by the bank

o C) Repayment term:

·

i) Asset

Financing

·

6 Months

moratorium on principal and interest, 5 years repayment period for asset

financing only

·

ii) Working

Capital Financing

·

12months equal

installment of principal and interest

Presidential Palliative Programmes Frequently Asked Questions

How do I access the loan?

Apply for the loan through the provided

website www.fedgrantandloan.gov.ng

while disbursement will be done by your bank if you meet the eligibility

criteria.

How will I know if I qualify?

The criteria are

provided on the website www.fedgrantandloan.gov.ng

What are the terms of the loan?

The loan term is 36

months for MSMEs and Manufacturers (Working capital) is 12 months, while

Manufacturers (Asset financing) has a 60-month tenor with a six-month

moratorium.

What if I don’t meet the criteria? Will I be

considered?

No

What is the interest rate of the loan?

9% per annum.

Is there a moratorium period?

There is a six-month

moratorium period for Manufacturers applying for asset financing only.

What if I can’t pay back the loan?

The bank will apply

all legal measures to recover the loan from the borrower.

Can I apply with a partner company?

Applicant must have

a registered business either as a Sole proprietorship, Partnership, or a

Limited liability company

Is there an age limit to application?

Yes,

applicants/promoters of the company have to be 18 years and above.

How long will it take from when I apply to

when I get the loan?

This is dependent on

your bank; however, it is typically expected to take 2 weeks.

Can I apply with different companies?

No, multiple

applications will be disqualified.

What are the repayment terms?

Equal and

consecutive monthly repayment of principal and interest for the tenor of the

loan.

How do I know the status of my application?

You can check the

status of your application by logging into your profile. Once your application

has been forwarded to your bank for processing, you should follow up with your

bank for updates.

Can I reapply if my application is rejected?

You may be able to

reapply if the reason for the rejection is a minor issue. You will be notified

of the rejection and advised to provide additional information.

Apply Now for Presidential Palliative Programmes

Eligible

applications who meet the selection criteria will be shortlisted.

- >> CLICK HERETO APPLY ONLINE